Consumer Protection Laws for Patients: What You Need to Know in 2025

Every year, millions of Americans face medical bills they never expected. Some get surprise charges from out-of-network doctors. Others are pressured to sign up for medical financing apps right after a diagnosis. And too many find their credit scores wrecked by hospital bills they couldn’t pay. That’s why consumer protection laws for patients have become essential-not just in theory, but in daily practice.

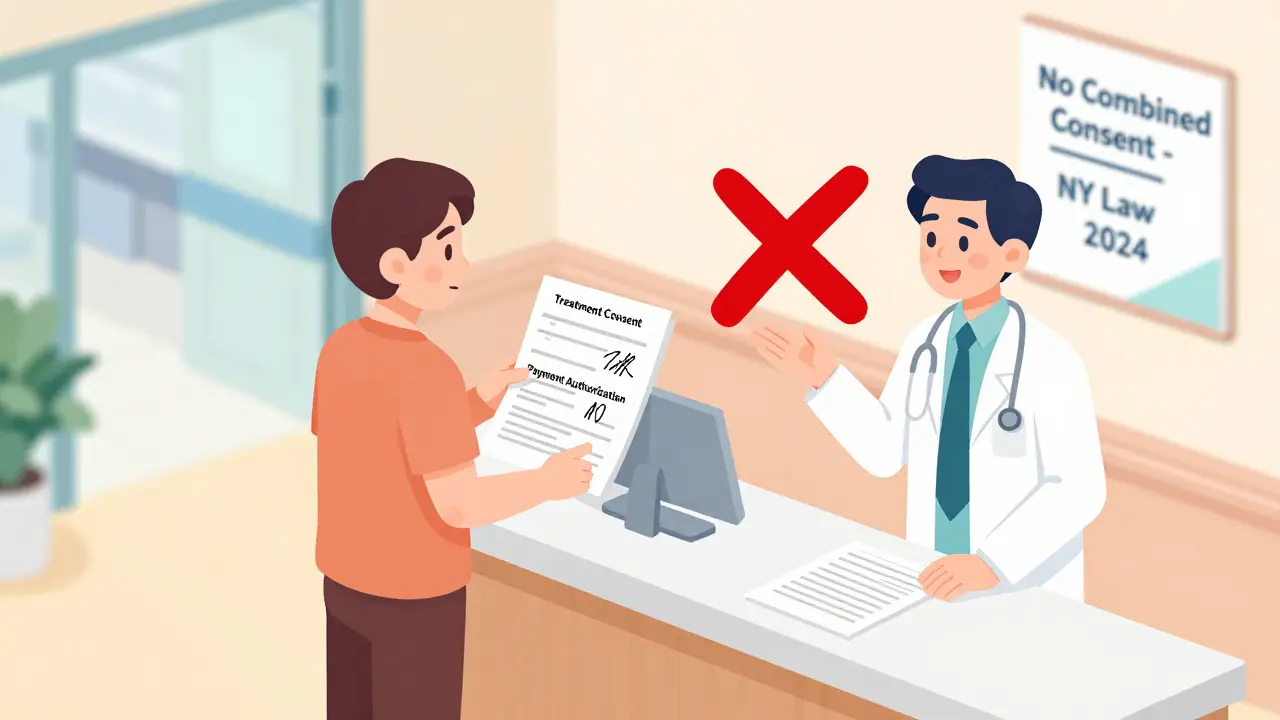

What Changed in New York in 2024?

On October 20, 2024, New York rolled out three new laws that flipped the script on how healthcare providers handle money and consent. These weren’t minor tweaks. They were full system overhauls designed to stop predatory practices that turned medical care into a financial trap. One of the biggest changes? You can no longer sign one form that gives your doctor permission to treat you and to bill you. Before, hospitals and clinics would hand you a stack of papers at check-in. You’d sign everything at once-consent for surgery, permission for lab tests, and authorization to charge your card or set up a payment plan-all in one signature. Now, under Public Health Law Section 18-c, providers must get separate, clear consent for treatment and for payment. If they don’t, they face a $2,000 fine per violation. But here’s the twist: as of August 2025, enforcement of Section 18-c was suspended. That doesn’t mean it’s gone. It means the state is still figuring out how to make it work without overwhelming clinics. Until then, providers are supposed to follow the spirit of the law: don’t trick patients into signing away financial rights while they’re stressed or in pain.No More Sneaky Financing Apps

You’ve seen it: you’re in the ER after a fall. The nurse hands you a tablet. "Just sign here to apply for CareCredit®." It sounds helpful. But under General Business Law Section 349-g, that’s now illegal. Healthcare providers can’t fill out any part of a medical financing application-not even helping you pick a plan or explaining interest rates. They can answer your questions. They can hand you the form. But you have to type everything yourself. Violations carry fines up to $5,000 per incident. Why? Because these financing products-like CareCredit®, CareLending, or Health Finance Group-are structured differently than credit cards. If you use them, you get special protections: no wage garnishment, no liens on your home, and medical debt can’t be reported to credit bureaus. But if you just use your Visa or Mastercard? You lose all of that. You’re treated like any other consumer debt. That’s why New York made it harder for providers to steer you toward the wrong option.Emergency Care Can’t Be Held Hostage

Imagine you’re rushed to the hospital after a car crash. You’re in pain. You can’t think straight. Then the billing office asks for your credit card number to "preauthorize" payment. That’s no longer allowed under General Business Law Section 519-a. Providers can’t require you to give them your credit card before giving you emergency or medically necessary care. They also can’t keep your card on file without your written permission. And if you do pay with a traditional credit card, they must give you a clear warning: "Using a credit card for medical services may subject you to higher interest rates and remove your access to medical debt protections." This law closes a dangerous loophole. Federal rules like the No Surprises Act stop surprise bills from out-of-network providers. But they don’t protect you if you use your credit card to pay for care you thought was covered. New York’s law says: if you’re getting emergency care, you shouldn’t be forced into a financial decision under duress.

Federal vs. State: What’s the Difference?

The No Surprises Act, which started in January 2022, protects you from surprise bills. If you go to an in-network hospital but get treated by an out-of-network anesthesiologist? You still only pay your in-network rate. That’s federal law. New York’s laws go further. They tackle what happens after you get care. They stop providers from pressuring you into financing. They force transparency about how payment methods affect your rights. They make sure you’re not signing away protections just because you’re tired, scared, or confused. And while the federal government removed medical debt from credit reports in 2024, New York’s laws go beyond that. They prevent the problem from happening in the first place-by stopping the practices that turn medical bills into long-term financial disasters.What This Means for You

If you’re a patient, here’s what you should do:- Always ask: "Is this consent for treatment or payment?" If they’re combined, say no. Demand separate forms.

- If someone offers you CareCredit® or a similar product, ask: "Can I complete this myself?" If they try to help you fill it out, politely refuse.

- Never give your credit card before emergency care. If they insist, ask to speak to a supervisor or file a complaint with the New York State Department of Health.

- If you’re asked to pay with a credit card, request the written warning about risks. Keep a copy.

- Know your rights: medical debt from financing programs is protected. Debt from regular credit cards is not.

What This Means for Providers

Clinics and hospitals are scrambling to adapt. Many still use old intake forms. Staff are confused. Training hasn’t caught up. Some are ignoring the rules because they don’t understand the penalties. But the cost of non-compliance is real. Fines add up fast. And patients are starting to push back. More are asking: "Why are you asking for my card before you even check my vitals?" Providers must now:- Redesign consent forms to separate treatment and payment.

- Train every front-desk employee on the new rules.

- Stop completing any part of medical financing applications.

- Provide written risk disclosures every time a patient uses a credit card.

- Keep records of compliance for at least six years.

What’s Next?

New York isn’t alone. The Consumer Financial Protection Bureau’s 2024 rule to remove medical debt from credit reports shows federal momentum. Experts predict other states will copy New York’s model-especially the credit card disclosure rules and the ban on preauthorization for emergencies. Meanwhile, the suspension of Section 18-c creates uncertainty. Is it paused indefinitely? Will it come back with stronger enforcement? Providers and patients alike are watching. The state hasn’t said. But one thing is clear: the era of treating medical care like a retail transaction is ending. Patients are no longer expected to sign away their financial rights just to get help. The system is changing. And if you know your rights, you can make sure you’re not left behind.Common Questions About Patient Protection Laws

Can a hospital refuse to treat me if I don’t give them my credit card?

No. Under New York’s General Business Law Section 519-a, healthcare providers cannot refuse emergency or medically necessary care because you won’t provide credit card information. If they do, you can file a complaint with the New York State Department of Health. This rule applies even if you’re uninsured.

What’s the difference between CareCredit® and a regular credit card for medical bills?

CareCredit® and similar medical financing products are designed specifically for healthcare. If you use them, your debt is protected under New York law: it can’t be reported to credit bureaus, and collectors can’t garnish your wages or place liens on your home. A regular credit card doesn’t offer these protections. Even if you use your Visa to pay a hospital bill, it’s treated like any other consumer debt.

Do these laws apply to all healthcare providers in New York?

Yes. The laws apply to all providers licensed by the New York State Department of Health, including hospitals, clinics, dentists, chiropractors, and mental health practices. Even small offices must comply. If you’re being asked to sign a combined consent form, you have the right to refuse and request separate forms.

What should I do if a provider filled out my CareCredit® application for me?

If a provider completed any part of your medical financing application-even just helping you pick a plan-you have grounds to file a complaint. Contact the New York State Department of Health or the Attorney General’s office. You may also be able to cancel the agreement, as it was obtained illegally. Keep any records, including emails or texts from staff.

Are these laws only in New York?

As of 2025, New York has the strongest and most comprehensive patient financial protection laws in the U.S. But other states are watching closely. Experts predict California, Illinois, and Massachusetts will introduce similar rules in 2026. Federal law still lags behind in regulating payment practices, so state-level action remains critical.

Comments (15)

Cara Hritz

22 Dec 2025

i swear every time i go to the doctor they hand me a 10-page form and say "just sign here" and i dont even know what im signing. now i just say no and ask for separate papers. they look at me like im crazy but hey, better than getting hit with a $5k bill for a bandaid

jenny guachamboza

23 Dec 2025

lol this is all just a distraction 🤭 the real plan is to get you hooked on government healthcare so they can track your every move. next they’ll make you sign a biometric consent form just to breathe. #NewWorldOrder

Aliyu Sani

23 Dec 2025

the structural violence embedded in medical billing is not new. what’s revolutionary is the recognition that consent cannot be commodified. when pain becomes a transactional moment, the body becomes collateral. this law? it’s not regulation-it’s rehumanization. we’ve forgotten that healing requires dignity, not just documentation.

Kiranjit Kaur

24 Dec 2025

finally someone’s doing something right!! 🙌 i had a friend get hit with a $12k bill after a simple ER visit because they signed up for CareCredit without knowing the interest was 29%... now i make sure to ask EVERY TIME. thank you NY for waking up 🌞

Sai Keerthan Reddy Proddatoori

26 Dec 2025

why do we let foreigners tell us how to run our hospitals? this is why america is falling apart. we used to be tough. now we coddle people with paperwork. just pay your bill like a man

Johnnie R. Bailey

26 Dec 2025

as someone who’s worked in rural clinics for 18 years, i’ve seen the chaos. staff used to fill out financing apps "to help"-not realizing they were breaking the law. training took months. forms had to be redesigned. now we have binders labeled "TREATMENT vs PAYMENT" on every desk. it’s a pain-but it’s right. patients are finally starting to ask questions. that’s the real win.

Tony Du bled

27 Dec 2025

my cousin got denied a CT scan because she wouldn’t give her card. they said "policy." she filed a complaint and they apologized. weird how the system works when you push back.

Art Van Gelder

28 Dec 2025

think about it-this isn’t just about forms or fines. it’s about power. who gets to decide what you owe when you’re vulnerable? when you’re shaking from pain, when you’re crying in the waiting room, when you’ve just been told your child has leukemia? that’s not a moment for a sales pitch. that’s a moment for humanity. New York didn’t just change a law-they changed the moral calculus of healthcare. And honestly? It’s about time. The rest of the country is watching. Not because it’s trendy. Because it’s necessary. We’ve normalized exploitation as efficiency. This law says: no more.

Kathryn Weymouth

30 Dec 2025

Correction: Section 18-c was suspended in August 2025, but the underlying statute remains active. Enforcement is paused pending administrative review-not repealed. Also, the federal medical debt removal rule took effect in March 2024, not January. Small details matter when people are relying on this info to protect their rights.

Nader Bsyouni

1 Jan 2026

so now we need laws to stop doctors from being nice? what next? laws to stop nurses from smiling? capitalism is just reality. if you cant afford care dont get sick. problem solved

Julie Chavassieux

2 Jan 2026

OMG I JUST REALIZED-my last visit they had me sign a form that said "I agree to all charges" and I didn’t even read it!! I’m going to sue them!! I’m gonna go viral!! I’m gonna get a lawyer!! I’m gonna... wait, do I need to file before the 30-day window??

Jeremy Hendriks

4 Jan 2026

you think this is about patients? it’s about control. the state doesn’t care if you get ripped off-they care if you lose trust in the system. this law isn’t protection-it’s damage control. they know people are fed up. so they give you a shiny new rule while the real rot keeps growing.

Ajay Brahmandam

4 Jan 2026

i work at a clinic in Bangalore and we have similar rules now. patients ask us "is this for treatment or payment?" like it’s normal. it’s beautiful. change starts small. NY is leading, but the movement is global.

Tarun Sharma

5 Jan 2026

Compliance requires documented staff training and retention of records for six years. Failure to adhere may result in civil penalties under N.Y. Gen. Bus. Law §§ 349-g and 519-a. Recommend consulting legal counsel for institutional implementation.

Gabriella da Silva Mendes

6 Jan 2026

why is this only in NY? what about the rest of the country? we’re getting screwed everywhere else. and don’t even get me started on how insurance companies still charge you $500 for a 5-minute visit. this law is cute but it’s just a Band-Aid on a bullet wound. and who’s gonna pay for all this new paperwork? the patient? the hospital? the government? someone’s gotta foot the bill. and it’s never the ones who made the rules.