Future of Global Generic Markets: Key Predictions and Trends Through 2030

The global generic drugs market isn't just about cheap pills. It's the backbone of affordable healthcare for billions. In 2024, generics made up 90% of all prescriptions in the U.S., yet accounted for only 23% of total drug spending. That’s the power of cost savings. With healthcare costs hitting $9.8 trillion globally in 2024, and chronic diseases affecting 41% of the world’s population, the demand for affordable medicines isn’t slowing down - it’s accelerating. But the future of this market isn’t as simple as more pills at lower prices. The rules are changing, and who wins depends on who adapts.

Generics Are Still Growing - But Not Everywhere

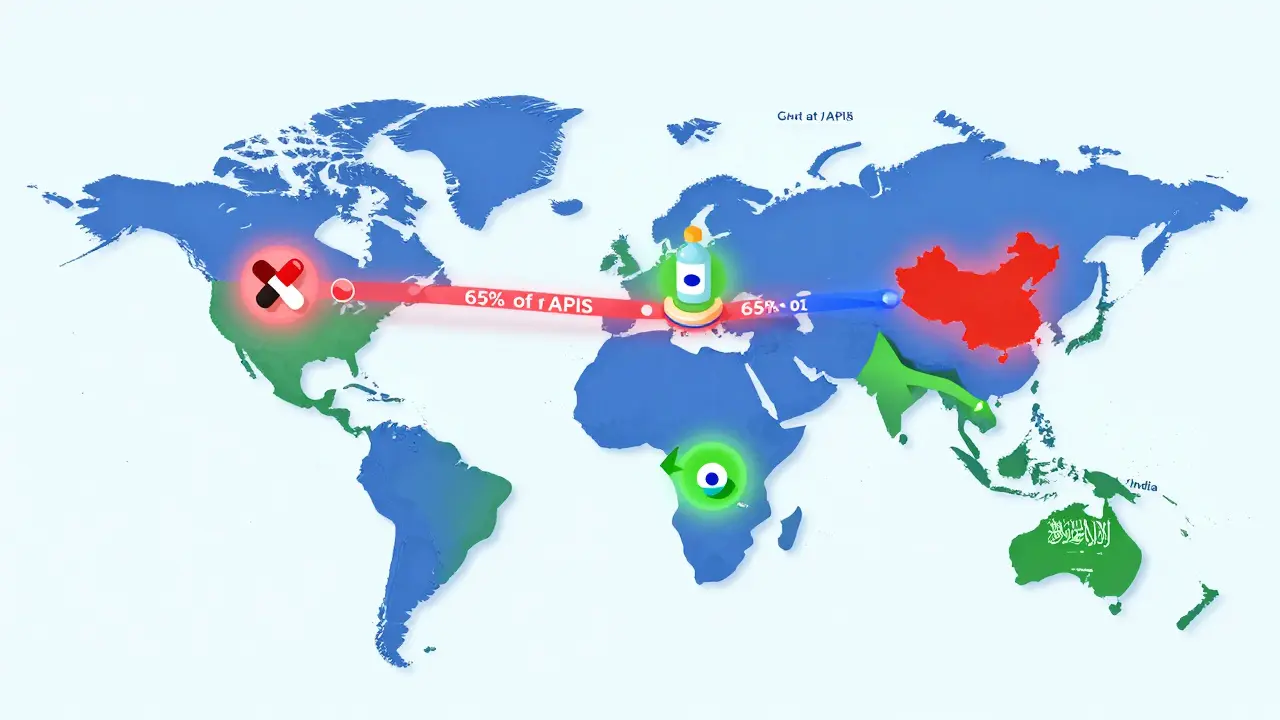

The global generic drug market was worth $435 billion in 2023. By 2028, it’s expected to hit $656 billion. That’s an 8.5% annual growth rate. Sounds strong? It is - but only if you look at the right places. In North America and Western Europe, growth is flatlining at 2-5% per year. Why? Price controls. Regulators keep forcing manufacturers to cut prices further, squeezing margins. In Germany, generics cover 72% of prescriptions. In Italy? Just 28%. That gap isn’t about need - it’s about policy. Countries with strict reimbursement rules are hitting a wall. Meanwhile, in places like India, Brazil, Turkey, and Saudi Arabia, the market is booming. These are called "pharmerging" markets - and they’re where nearly all the future growth is happening.India and China: The Engines of Supply

If you take a pill today, chances are it came from India or China. India produces over 60,000 different generic medicines and supplies 20% of the world’s generic drug volume by volume. China makes 40% of all active pharmaceutical ingredients (APIs) - the raw chemical building blocks of drugs. Together, they control about 35% of global manufacturing capacity. That’s not a coincidence. It’s strategy. India’s government pumped $1.34 billion into its Production Linked Incentive (PLI) scheme in 2024 to boost domestic manufacturing. China, meanwhile, controls the supply chain from raw materials to finished tablets. But this dependence is risky. In 2024, 65% of global APIs for generics came from China. One disruption - a flood, a trade ban, a factory shutdown - could ripple across the world. Countries like Egypt and Saudi Arabia are now pushing for local production. Egypt requires 50% of essential medicines to be made locally by 2025. That’s the new normal.Biosimilars: The Next Big Thing

The old model of copying small-molecule drugs is getting harder. Why? Because the next wave of blockbuster drugs aren’t pills - they’re biologics. These are complex, living-cell-based treatments for cancer, autoimmune diseases, and diabetes. When their patents expire, they don’t get copied like regular generics. They get biosimilars. And biosimilars are a whole different game. Developing one costs $100-250 million - compared to $1-5 million for a traditional generic. It takes 10 to 20 times more manufacturing steps. The payoff? Biosimilars can still be priced 15-30% below the original biologic - far less than the 80-85% discount of traditional generics. But they’re growing fast. The biosimilar segment is projected to grow at 12.3% annual rate from 2025 to 2030. Companies that can build the labs, the quality systems, and the regulatory expertise to make these drugs will dominate. Smaller generic makers? They’re being left behind.

Quality Is Still a Wild Card

Here’s the dark side: one in every two warning letters the FDA issued in 2023 came from foreign generic manufacturers. That’s 187 warning letters - mostly because of dirty facilities, falsified data, or poor quality control. Dr. Elena Rodriguez of the FDA said in 2024 that 40% of all warning letters targeted foreign plants. That’s not just a regulatory issue - it’s a public health risk. In some countries, regulators lack the resources to inspect factories properly. That’s why countries like Saudi Arabia and the UAE are investing heavily in their own regulatory bodies. They know: if you want to be trusted, you have to prove you’re clean. The market won’t accept cheap drugs if they’re unsafe.Why Margins Are Squeezed - And How Companies Are Fighting Back

In 2020, generic manufacturers made an average profit margin of 18%. By 2024, that dropped to 12%. Why? Too many players, too little differentiation. When everyone sells the same pill, the only thing left to compete on is price. And price keeps falling. So the smart ones are changing tactics. Some are becoming bigger - buying up competitors to cut costs. Others are cutting out middlemen and selling directly to hospitals or governments. A few are shifting from selling pills to selling services - like drug delivery systems, patient monitoring, or adherence programs. KPMG’s Dr. Sarah Thompson says the winners will be those who "become bigger, eliminate middlemen, and develop innovative service models." It’s no longer just about chemistry. It’s about logistics, data, and trust.

The Long-Term Shift: Generics Lose Share, But Not Relevance

By 2030, generics will still be the most prescribed drugs. But their share of total drug spending will drop. In 2024, they made up 57.56% of the global pharmaceutical market by revenue. By 2030, that’s projected to fall to around 53%. Why? Because expensive specialty drugs - like GLP-1 weight-loss medications, gene therapies, and personalized cancer treatments - are rising fast. These drugs aren’t cheap. But they’re profitable. And they’re where the big pharma companies are putting their money. That doesn’t mean generics are dying. It means they’re becoming more focused. They’re no longer the entire market - they’re the foundation. The part that keeps healthcare from collapsing under its own cost.What’s Next? Three Real Paths Forward

- Build local capacity: Countries that want control over their medicine supply are investing in domestic manufacturing. This isn’t nationalism - it’s security.

- Move into biosimilars: If you’re a generic manufacturer and you’re still only making old-school pills, you’re already behind. The future is in complex biologics.

- Fix the supply chain: Relying on one country for 65% of your raw materials is a gamble. The next decade will see more regional supply hubs - in Southeast Asia, Eastern Europe, and Latin America.

The global generic market isn’t fading. It’s evolving. The winners won’t be the ones with the lowest prices. They’ll be the ones with the cleanest factories, the most reliable supply chains, and the smartest strategies.

Why are biosimilars more expensive to make than regular generics?

Biosimilars are made from living cells - like proteins or antibodies - not synthetic chemicals. This means the manufacturing process is incredibly complex, requiring precise conditions, sterile environments, and advanced purification techniques. A single biosimilar can take over 100 steps to produce, compared to fewer than 10 for a traditional small-molecule generic. Development costs range from $100 million to $250 million, while a standard generic costs just $1-5 million to bring to market.

Which countries are leading in generic drug production?

India and China are the top two. India produces over 60,000 generic medicines and supplies 20% of the world’s generic drug volume by volume. China manufactures about 40% of global active pharmaceutical ingredients (APIs), the raw materials used to make pills. Together, they account for roughly 35% of global manufacturing capacity. Other growing players include Brazil, Turkey, and Egypt, which are pushing for local production.

How much cheaper are generic drugs compared to branded ones?

Traditional generic drugs are typically priced 80-85% lower than their branded equivalents. For example, if a branded heart medication costs $100 per month, the generic version might cost $15-20. Biosimilars, which copy complex biologic drugs, are less discounted - usually 15-30% cheaper - because their production is far more expensive and technically demanding.

Are generic drugs as safe and effective as branded drugs?

Yes - when they’re made properly. Regulatory agencies like the FDA and EMA require generics to have the same active ingredients, dosage, strength, and performance as the original. But quality varies by manufacturer. In 2023, the FDA issued 187 warning letters to foreign generic factories over issues like contamination, poor recordkeeping, and falsified data. The key is buying from manufacturers in countries with strong oversight - like the U.S., EU, India (under strict compliance), or Japan.

Why are generic drug margins falling?

Margins dropped from 18% in 2020 to 12% in 2024 because of oversupply and price pressure. When dozens of companies can make the same generic drug, they compete on price - and that drives profits down. Governments also force price cuts to control healthcare spending. To survive, manufacturers are merging, cutting distribution layers, and moving into higher-value products like biosimilars or service-based models.

What role do pharmerging markets play in the future of generics?

Pharmerging markets - like India, Brazil, Turkey, Saudi Arabia, and Egypt - are the main drivers of future growth. They’re expanding health insurance, building hospitals, and pushing for affordable medicines. IQVIA estimates these markets will add $140 billion in drug spending by 2025. They’re not just consumers - they’re becoming producers. Countries like Egypt now require 50% of essential medicines to be made locally, reducing dependence on imports and creating new manufacturing hubs.

Comments (12)

pradnya paramita

4 Feb 2026

The structural shift in generic pharmaceuticals is no longer about volume-it’s about value chain integration. With biosimilars commanding a 12.3% CAGR through 2030, the competitive moat is shifting from cost efficiency to manufacturing fidelity. The real differentiator isn’t API sourcing anymore-it’s GMP compliance at scale, especially with FDA warning letters up 47% YoY. Countries like India and China are no longer just suppliers; they’re becoming regulatory arbitrage zones. The future belongs to vertically integrated players who control both API synthesis and final formulation under single audit frameworks.

caroline hernandez

6 Feb 2026

It’s encouraging to see how pharmerging markets are redefining access. India’s PLI scheme isn’t just about subsidies-it’s about building sovereign manufacturing capacity. When Egypt mandates 50% local production, it’s not protectionism-it’s resilience engineering. The real win here is that affordability isn’t just about price-it’s about supply chain sovereignty. More countries are realizing that healthcare security isn’t a luxury; it’s a strategic imperative. This isn’t a race to the bottom-it’s a race to build trusted infrastructure.

Zachary French

6 Feb 2026

OMG this is the most woke generic drug manifesto I’ve ever read 😭 Like, yeah, biosimilars are expensive-but did you know the FDA’s own inspection backlog is 3 years deep? And China’s API monopoly? That’s not a supply chain-it’s a hostage situation. Meanwhile, in the U.S., we’re still paying $1200 for a 30-day supply of insulin while India ships 20% of the world’s generics from factories that smell like burnt plastic. Wake up. This isn’t medicine. It’s a geopolitical poker game where the patients are the ones getting bluffed.

Daz Leonheart

7 Feb 2026

There’s a quiet revolution happening here that most people miss. The decline in generic margins isn’t a failure-it’s a signal. When competition drives prices down, it forces innovation. Companies that are shifting from pills to service models-like adherence tracking or digital dispensing-are already seeing 3x ROI. This isn’t about selling drugs anymore. It’s about building patient ecosystems. The winners will be the ones who stop thinking like chemists and start thinking like healthcare engineers.

Amit Jain

9 Feb 2026

Simple truth: India makes the pills. China makes the chemicals. USA and EU pay for them. If you think this is sustainable, you’re not looking at the real numbers. One factory shutdown in Shanghai and half the world’s metformin vanishes overnight. Local production isn’t optional anymore-it’s survival. Egypt’s 50% rule? Smart. Brazil’s new labs? Good. Everyone else is just waiting for the next crisis.

Keith Harris

10 Feb 2026

Oh wow, another ‘pharmerging’ buzzword salad. Let me guess-you also think ‘supply chain resilience’ is code for ‘let’s make everything twice as expensive and call it patriotism.’ Newsflash: 80% of the world’s generic drugs are cheap because they’re made under conditions that would get a US plant shut down in 48 hours. You want ‘quality’? Fine. But don’t pretend you’re not trading safety for affordability. And biosimilars? They’re just branded drugs with a new label and a 30% discount. The whole system is a house of cards built on regulatory arbitrage and moral hypocrisy.

Nathan King

12 Feb 2026

The evolution of the generic pharmaceutical market reflects a broader paradigm shift in global health economics. The transition from commodity-based pricing to value-based delivery models is not merely a tactical adjustment-it constitutes a structural reorientation. The persistent reliance on low-cost manufacturing hubs, while economically expedient, introduces systemic vulnerabilities that are incompatible with the exigencies of 21st-century public health infrastructure. Consequently, the imperative for regional manufacturing ecosystems, underpinned by robust regulatory governance, is not merely prudent-it is ontologically necessary.

rahulkumar maurya

13 Feb 2026

Let’s be brutally honest: if you’re still manufacturing small-molecule generics in 2025 without a biosimilar pipeline, you’re already a corpse walking. The days of competing on price per tablet are over. The real game is IP architecture, clinical data packages, and regulatory fluency. India’s PLI scheme? A Band-Aid. China’s API dominance? A ticking bomb. The only players who’ll survive are those who’ve already spent $200M on bioreactors and FDA-certified clean rooms. Everyone else? They’re just renting shelf space in a dying industry.

Alec Stewart Stewart

14 Feb 2026

I’ve been in this space for 15 years, and honestly? The most hopeful thing I’ve seen is how countries like Saudi Arabia and Brazil are stepping up-not just buying drugs, but building labs, training inspectors, and hiring local chemists. It’s not glamorous. It’s not fast. But it’s real. Healthcare doesn’t have to be a global lottery. We can build systems that are reliable, fair, and local. It just takes willpower. And maybe a little patience.

Demetria Morris

14 Feb 2026

It’s disgusting how we glorify ‘affordability’ while ignoring the human cost. Factories with no ventilation, workers breathing in chemical dust, falsified batch records-all justified because ‘people need medicine.’ But when the FDA issues 187 warning letters, it’s not a glitch. It’s a moral failure. We don’t need more generics. We need better oversight. And until we stop treating developing nations as dumping grounds for our regulatory burdens, we’re not helping-we’re exploiting.

Geri Rogers

15 Feb 2026

YESSSS! 🙌 This is exactly why I’ve been pushing for local manufacturing hubs in my region. Biosimilars are the future, and if we don’t build the capacity now, we’ll be begging for pills again when the next crisis hits. India and China aren’t villains-they’re engines. But we need more engines! Let’s fund labs, train technicians, and stop outsourcing our health to a single continent. 💪🌍 This is the healthcare revolution we can actually build-no magic, just hard work.

Samuel Bradway

16 Feb 2026

I just think we need to stop pretending this is all about science. It’s politics. It’s money. It’s who gets to decide what’s safe. The FDA doesn’t inspect every factory. The WHO doesn’t have the power. So we’re left with a system where people get medicine, but not always medicine they can trust. Maybe the real solution isn’t more factories-it’s transparency. Make the inspection reports public. Let patients see the audit results. Let them choose. Trust shouldn’t be assumed. It should be earned.