Future Economic Trends: Forecasts for Generic Drug Markets

The global generic drug market isn’t just growing-it’s reshaping how the world pays for medicine. By 2030, it could be worth anywhere between $530 billion and $800 billion, depending on who you ask. What’s clear is that cheaper, equally effective versions of branded drugs are no longer a niche alternative. They’re becoming the backbone of healthcare systems struggling with rising costs and aging populations. And the biggest wave of change is just starting.

Why the Generic Drug Market Is Exploding

Between 2025 and 2030, drugs making over $200 billion a year in sales will lose their patent protection. That’s not a small number. It’s the equivalent of the entire GDP of a mid-sized country suddenly opening up to competition. Drugs like ustekinumab and vedolizumab-used to treat autoimmune diseases like psoriasis and Crohn’s-are hitting their patent cliffs. These aren’t obscure pills. They’re blockbusters. And once generics enter, prices drop by 80% or more. This isn’t just about saving money for patients. It’s about keeping hospitals and insurers afloat. In the U.S., Medicare and Medicaid spend billions each year on prescription drugs. In Europe, national health services are under constant pressure to cut costs. Generic drugs let them stretch budgets further without sacrificing care. A 2024 report from DrugPatentWatch found that the average generic version of a branded drug costs just 10-20% of the original price. That’s not a discount-it’s a revolution.Where the Growth Is Happening

Not all regions are growing at the same pace. Asia-Pacific is the fastest-moving market, led by India and China. India alone supplies 20% of all generic drugs sold worldwide and 60% of the global vaccine supply. Its manufacturers have built massive, low-cost production lines that can churn out millions of tablets a day. China isn’t far behind. Its government-run volume-based procurement system forces drugmakers to bid for contracts by slashing prices. The result? Global benchmark prices for common drugs like metformin or atorvastatin have been reset downward-sometimes by half-in just a few years. Europe is more mature but still growing. Germany and the UK lead the continent in generic adoption, thanks to strong regulatory support and public policies that actively encourage prescribing generics. In the UK, over 85% of prescriptions are now for generic drugs. That’s not just policy-it’s habit. Doctors and pharmacists know they work. Patients trust them. And the system saves billions annually. The U.S. market is crowded and competitive. Companies like Teva, Viatris, and Amneal dominate, but margins are thin. The FDA approved over 1,300 generic drugs in 2024 alone, the highest number in a decade. Yet, profit margins are shrinking because of price erosion and consolidation. The big players are buying up smaller ones just to stay in the game.Biosimilars: The New Frontier

The next big wave isn’t just about copying old pills. It’s about copying complex biologic drugs-protein-based treatments made in living cells. These are the drugs used for cancer, rheumatoid arthritis, and diabetes. They used to cost $100,000 a year. Now, biosimilars-generic versions of biologics-are entering the market at 15-35% lower prices. The growth rate for biosimilars is nearly double that of traditional generics: 8.2% CAGR through 2030, according to DrugPatentWatch. Why? Because they’re harder to make. You can’t just reverse-engineer a biologic like you can a pill. You need advanced labs, strict quality controls, and years of testing. That means fewer companies can enter the market-and those who do can charge a premium. The EU and Japan are leading in biosimilar approvals. The EU has approved over 70 biosimilars since 2006. Japan is fast-tracking approvals to catch up. The U.S. is slower, but the pipeline is filling. By 2029, biosimilars for drugs like Humira, Enbrel, and Rituxan could save the U.S. healthcare system over $25 billion annually.

Therapeutic Areas Driving Demand

Not all generic drugs are created equal. Some categories are growing faster than others because of rising disease rates. Oncology is the biggest. Even though branded cancer drugs still dominate sales, the number of patents expiring is rising fast. Drugs like rituximab and trastuzumab are already seeing generic competition. By 2030, over $300 billion in cancer drug sales will be open to generics and biosimilars. Diabetes is another major driver. With over 500 million people worldwide living with diabetes, the demand for insulin and GLP-1 agonists like liraglutide is skyrocketing. Generic insulin is already available in some countries. In the U.S., the first generic versions of insulin glargine hit shelves in 2024 at 75% lower prices. More are coming. Cardiovascular drugs like statins and blood pressure meds have been generics for years-but demand keeps climbing. As populations age, more people need these drugs. In the UK, over 12 million prescriptions for statins were issued in 2024. Almost all were generic. And don’t forget antibiotics. With rising resistance and global health threats, governments are stockpiling generic antibiotics. The U.S. government’s Biomedical Advanced Research and Development Authority (BARDA) has invested hundreds of millions into securing generic antibiotic supplies.Manufacturing and Technology Are Changing the Game

Making generics isn’t just about grinding powder and filling capsules anymore. It’s becoming a high-tech industry. Robotic automation is cutting labor costs and improving precision. Companies in India and China are installing fully automated production lines that can run 24/7 with minimal human oversight. This reduces contamination risks and increases output. Data analytics is helping manufacturers predict which drugs will come off patent next-and which ones will be most profitable to copy. Tools that track patent filings, regulatory timelines, and payer behavior are now standard in generic drug R&D departments. And then there’s medication synchronization. Tech platforms now help pharmacies coordinate refills for patients on multiple chronic meds. This reduces missed doses and increases refill rates-making generic drugs more effective and more profitable for pharmacies.

Challenges Ahead

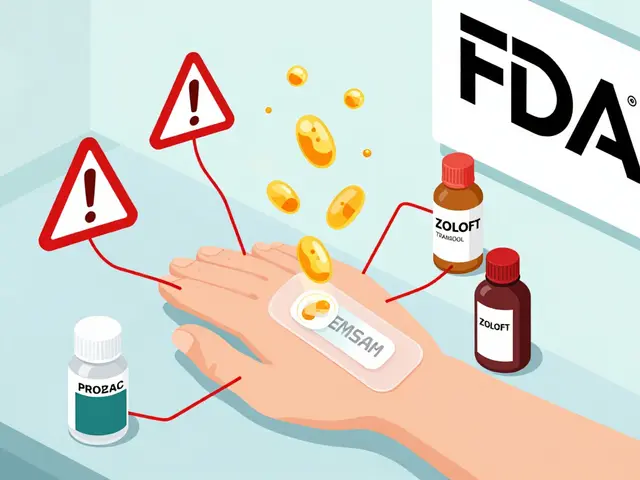

The future looks bright, but it’s not without risks. Pricing pressure is the biggest threat. In China, volume-based procurement has driven prices so low that some manufacturers are losing money. Smaller companies can’t compete. Consolidation is inevitable. Regulatory delays still exist. The FDA and EMA are approving generics faster than ever, but backlogs remain. A complex biosimilar can take 5-7 years to get approved. That’s a long time to wait for a return on investment. Patent litigation is another hurdle. Brand-name companies often file lawsuits to delay generic entry. These legal battles can push back market access by months or even years. In the U.S., over 100 patent challenges were filed against blockbuster drugs in 2024 alone. And then there’s the quality gap. Not all generics are made the same. In some low-income countries, counterfeit or substandard generics still circulate. Regulatory agencies are cracking down, but enforcement is uneven.What Comes Next

The generic drug market is moving from simple copies to sophisticated, high-value products. The next decade will see more biosimilars, more complex molecules, and more integration with digital health tools. Companies that invest in technology, regulatory expertise, and global supply chains will thrive. Those that treat generics as a commodity will be left behind. Health systems around the world are betting on generics to control costs. Patients are demanding them. And manufacturers are adapting. The result? More affordable medicine for millions. That’s not just an economic trend. It’s a public health win.What is the difference between a generic drug and a biosimilar?

A generic drug is an exact chemical copy of a small-molecule branded drug, like aspirin or metformin. It’s made using the same ingredients and manufacturing process. A biosimilar, on the other hand, is a copy of a complex biologic drug-like insulin or Humira-that’s made from living cells. Biosimilars aren’t identical to the original, but they’re proven to work the same way. They’re harder to make, more expensive to develop, and have higher approval barriers than traditional generics.

Why are generic drugs so much cheaper than brand-name drugs?

Brand-name companies spend billions on research, clinical trials, and marketing to get a drug approved. Generic manufacturers don’t have to repeat those expensive studies. They only need to prove their version is bioequivalent-meaning it works the same in the body. That cuts development costs by 80-90%. They also don’t spend money on advertising. That’s why a generic version of a drug that costs $300 a month can sell for $15.

Which countries are the biggest producers of generic drugs?

India is the world’s largest producer, supplying 20% of global generic volume and 60% of vaccine demand. China is the second-largest, especially for active pharmaceutical ingredients (APIs). The U.S. and Europe produce generics too, but they rely heavily on imports from Asia. Germany and the UK lead in Europe in terms of generic usage, not production.

Are generic drugs as safe and effective as brand-name drugs?

Yes. In the U.S., the FDA requires generics to meet the same strict standards as brand-name drugs for quality, strength, purity, and performance. They must deliver the same amount of active ingredient into the bloodstream at the same rate. Over 90% of generic drugs are rated as therapeutically equivalent. There are rare cases of differences in inactive ingredients causing side effects, but these are uncommon and closely monitored.

How will the patent cliff affect drug prices in 2025-2030?

The patent cliff-when dozens of high-revenue drugs lose exclusivity-will cause massive price drops. Drugs like ustekinumab, vedolizumab, and liraglutide could see price reductions of 70-90% within months of generic entry. This will lower costs for insurers, governments, and patients. In markets like the U.S., where drug prices are high, this could save hundreds of billions over the next five years. However, manufacturers may lower prices even further to win market share, squeezing profit margins.

Comments (9)

Jenny Lee

17 Nov 2025

Generic drugs are literally saving lives and budgets-why are we still acting like this is controversial?

Brandon Lowi

19 Nov 2025

Let’s be real-America’s pharma oligarchs are terrified because the Indian and Chinese factories are outproducing, outpricing, and outsmarting them. This isn’t capitalism-it’s colonialism with pill bottles. We imported the medicine, but we didn’t import the will to fix our broken system. Now they’re laughing at our $200 insulin while their people get it for $2. And we wonder why trust in institutions is collapsing?!

They don’t need patents-they need PR. And we’re still paying for the myth that ‘Made in USA’ equals ‘better.’ Please. The FDA approves generics faster than your ex replies to your texts. It’s not about safety-it’s about profit. And someone’s got to break the spell.

Every time you buy a generic, you’re voting against the corporate circus. And if you’re still clinging to brand-name drugs because ‘they’re more reliable,’ you’re not being cautious-you’re being manipulated. The science doesn’t lie. The FDA doesn’t lie. The only thing lying is the stock price of Big Pharma.

Joshua Casella

20 Nov 2025

This is one of the most important economic shifts of our generation, and most people don’t even realize it’s happening. Generic drugs aren’t just cheaper-they’re democratizing healthcare. The fact that a diabetic in rural Ohio can now afford insulin because a factory in Hyderabad figured out how to make it efficiently? That’s progress. We need more policies that incentivize this, not block it.

The biosimilar wave is especially exciting. We’ve been stuck with $70,000-a-year cancer drugs for too long. If we can cut that by a third without sacrificing outcomes, that’s not just cost-saving-it’s moral. We should be celebrating the engineers, regulators, and manufacturers making this possible-not demonizing them as ‘cheap alternatives.’

Let’s stop pretending this is about quality. It’s about access. And access is a human right, not a market privilege.

Richard Couron

22 Nov 2025

They're lying about generics being safe. You think the FDA really checks every batch from India? Nah. They're getting paid off. I read a guy on a forum who said his generic blood pressure med made him dizzy for weeks-brand name fixed it. And what about the heavy metals? They're dumping lead in the pills to cut costs. The WHO knows. The CDC knows. But they won't tell you because they're in bed with Big Pharma AND Big China. This is a slow poison. And they call it 'affordable care.' Ha!

Why do you think the U.S. stopped making APIs? Because they wanted you dependent. Now you can't even get a pill without trusting a factory that doesn't speak English. It's a supply chain trap. And soon, they'll control your insulin, your antibiotics, your mental meds. You think this is freedom? It's serfdom with a prescription pad.

Evan Brady

22 Nov 2025

One thing people overlook: the real innovation isn’t just in making the pills-it’s in the logistics. Companies are now using AI to predict patent expirations down to the month, then pre-building supply chains before the patent even expires. That’s why generics hit the market so fast now. It’s not luck-it’s data-driven warfare against monopolies.

And the automation? Factories in Tamil Nadu and Jiangsu are running robotic lines that fill, seal, and inspect 10,000 capsules per minute with near-zero error rates. Human error used to be the bottleneck. Now it’s corporate resistance to change.

Also, medication synchronization isn’t just convenient-it’s clinically significant. Patients on 5+ meds miss 40% of doses without coordinated refills. Generic + sync = better adherence = fewer ER visits. That’s a triple win: cheaper, safer, smarter.

The only thing holding us back is outdated reimbursement models. Insurance still pays the same for a $15 generic as a $300 brand. No incentive to switch. Fix that, and we’ll see adoption hit 95% in the U.S. overnight.

Ram tech

23 Nov 2025

India make all generic? lol. My cousin work in pharma, say most API come from china, india just mix and pack. Also, lot of fake generic in africa and south america. US FDA not care if it work, just want paper work done. Easy money.

Erica Lundy

24 Nov 2025

There is a profound philosophical shift occurring here: the commodification of biological efficacy. We have moved from treating medicine as a sacred artifact-crafted, patented, and protected-to viewing it as a utilitarian input in a global supply chain. The moral weight of this transition is rarely acknowledged. When a drug ceases to be a product of individual scientific genius and becomes a line item on a spreadsheet, what does that say about our collective values?

Is the reduction of cost to 10% of its original price a triumph of human ingenuity-or a surrender to utilitarianism? We celebrate the lower price, yet we rarely interrogate the erosion of the intellectual and ethical infrastructure that made the original possible. The generic is not merely a copy; it is a redefinition of value itself.

And yet, paradoxically, it is this very act of copying that has enabled the most equitable access to life-sustaining treatment in human history. So perhaps the tension is not between innovation and access-but between reverence and responsibility.

We must ask: do we honor the scientist who discovered the molecule, or the laborer who manufactured it at scale? Or, perhaps, do we honor both-and in doing so, redefine what ‘progress’ means?

Kevin Jones

24 Nov 2025

Patent cliffs aren’t cliffs-they’re avalanches. And the pharmaceutical industry is standing at the bottom, covered in snow, yelling about ‘innovation.’ Meanwhile, biosimilars are the new nuclear option: complex, expensive to develop, but unstoppable. The game changed. The players who don’t adapt? They’re not bankrupt-they’re irrelevant.

Premanka Goswami

24 Nov 2025

They say generics are safe-but have you ever seen the factories? I’ve seen videos. They use the same machines that make fertilizer. And the inspectors? They fly in for a day, take selfies with the CEO, and sign off. Meanwhile, your grandma’s blood pressure med is laced with unapproved solvents. This isn’t healthcare-it’s a global Ponzi scheme. And the FDA? They’re just the accountant who got paid to look away.

China owns the supply chain. India owns the packaging. The U.S. owns the debt. And we’re supposed to be grateful? Wake up. This isn’t progress. It’s surrender.