Switching Health Plans? How to Check Generic Drug Coverage and Save Money

When you switch health plans, your prescriptions shouldn’t become a financial surprise. Yet every year, thousands of people find out too late that their $5 generic blood pressure pill is now a $40 copay - or worse, not covered at all. The problem isn’t the drug. It’s the formulary.

What Is a Formulary, and Why Does It Matter?

A formulary is the list of drugs your insurance plan covers. It’s not just a catalog. It’s a pricing map. Drugs are grouped into tiers, and each tier has a different cost to you. Tier 1 is almost always generics. Tier 2 is brand-name drugs or higher-cost generics. Higher tiers mean higher prices. In 2025, nearly all individual and employer plans use a 3- to 5-tier system. Medicare Part D plans follow similar rules. The key? Not all generics are treated the same. Some plans put your metformin in Tier 1 with a $3 copay. Others stick it in Tier 2 with a $25 copay - even if it’s the exact same chemical.How Generic Drug Tiers Work in Different Plans

Not all plans are built the same. Here’s how coverage breaks down:- Marketplace Silver SPD plans (Special Design Plans): These are the gold standard for generic drug users. They waive your medical deductible for Tier 1 generics. You pay a flat $10-$20 copay, no matter how much you’ve spent on care this year. In 2023, KFF found these plans saved low-income users up to $1,200 annually on just three common generics.

- High-deductible health plans (HDHPs): These look cheap on paper - low monthly premiums. But if your plan combines your medical and prescription deductibles, you pay 100% out-of-pocket for every pill until you hit $2,000 or more. That’s $150/month for your diabetes meds before insurance kicks in.

- Medicare Part D: In 2025, the base deductible is $505. But most plans don’t charge it for Tier 1 generics. Instead, you pay $0-$10 per prescription. The catch? Some plans label your generic as “non-preferred,” bumping it to Tier 2 with a $30 copay.

- Employer plans: These vary wildly. One company might offer $5 generics pre-deductible. Another might make you wait until you hit a $1,500 deductible. Check your plan documents - don’t assume.

State Rules Change Everything

Your state isn’t just a location - it’s a rulebook. California requires a $85 outpatient drug deductible before generics kick in. New York waives all deductibles for generics and caps copays at $7. In DC, there’s a separate $350 drug deductible with a $150 cap on specialty drugs. This matters because if you move or switch plans within the same state, your costs can swing by hundreds of dollars. A 2023 KFF analysis showed that Californians paid 20% coinsurance on generics after their deductible. New Yorkers paid $0. Same drug. Same manufacturer. Different state laws.What You Must Check Before Switching

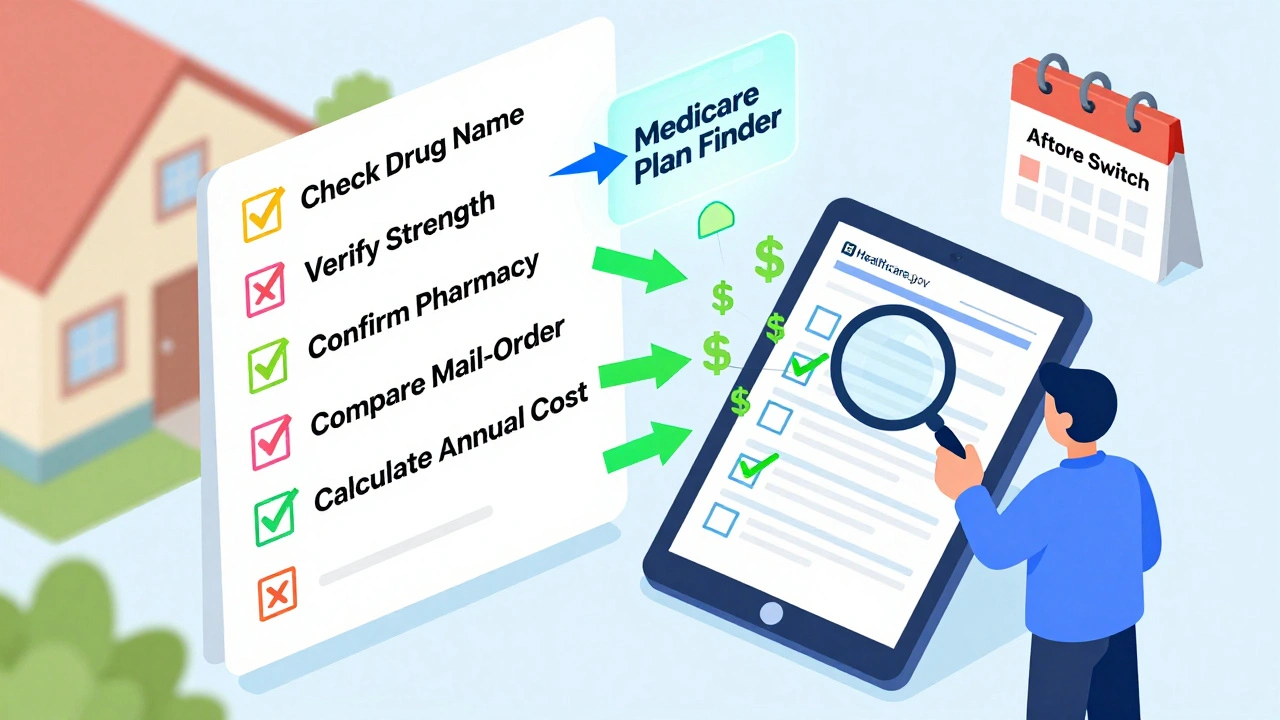

Don’t just glance at the plan’s summary. Dig into the full formulary. Here’s your checklist:- Find your exact drug name - including the manufacturer. Metformin made by Teva might be Tier 1. Metformin made by Mylan might be Tier 2. They’re chemically identical. But insurers treat them differently.

- Check the strength. Is your pill 500mg or 1000mg? Some plans cover one but not the other.

- Verify your pharmacy. If your local CVS isn’t in-network, your $3 generic becomes a $12 one. OptumRx data shows non-preferred pharmacies can charge 300-400% more.

- Look at mail-order options. Many plans offer 90-day supplies for the price of two 30-day fills. That’s a 33% savings if you’re on maintenance meds.

- Calculate your annual cost. Multiply your monthly copay by 12. Add in any deductible you must meet first. Then compare it to your current plan.

Real Stories: What Goes Wrong

Reddit users posted 147 cases in 2023 where switching plans broke their medication budget. Most common?- “My levothyroxine cost $0 last year. This year? $45. The new plan says it’s ‘non-preferred.’ But it’s the same pill.”

- “I switched to a cheaper plan. Didn’t check the formulary. My insulin went from $0 to $120/month.”

- “I didn’t know my pharmacy wasn’t in-network. My $5 generic became $18. I skipped doses for two months.”

Tools That Actually Work

Stop guessing. Use these:- Medicare Plan Finder (medicare.gov): Type in your drugs. It shows exact copays across all Part D plans in your area. Used by 4.2 million people in 2022.

- Healthcare.gov plan selector: Filter plans by “prescription drug coverage.” It pulls in formulary data from insurers.

- Your insurer’s formulary search tool: Most have one. Use it. A 2023 study found insurer tools are 96% accurate. Third-party sites? Only 78%.

What’s Changing in 2025

New rules are coming:- Insulin cap: Still $35/month under the Inflation Reduction Act. No deductible. No surprise.

- Medicare Part D out-of-pocket cap: Starting in 2025, you won’t pay more than $2,000 a year for all your drugs - even brand names.

- Formulary changes: Medicare is splitting generics into Tier 1 (preferred) and Tier 1+ (non-preferred). This means more plans will charge different prices for the same drug.

- AI tools: CMS launched a beta tool called “Medicare Plan Scout” in late 2023. It cut enrollment errors by 44% in testing.

Don’t Skip This Step

Switching plans is about more than premiums. It’s about whether you can afford to take your pills. A 2022 American Pharmacists Association study found 68% of people switching plans didn’t check if their specific generic formulation was covered. That’s how people end up skipping doses - or going into debt. If you take even one generic medication regularly, spend 30 minutes on your formulary. Write down your drugs. Check the tier. Check the pharmacy. Check the copay. Compare it to your current plan. The difference between a $3 copay and a $30 copay isn’t just money. It’s health. It’s stability. It’s not having to choose between your blood pressure pill and your groceries.Final Tip: When in Doubt, Call

Formularies are confusing. Websites lie. PDFs are outdated. If you’re unsure, call the insurer. Ask: “Is my drug [exact name and strength] covered? What tier? What’s the copay at my pharmacy? Is there a deductible I need to meet first?” Write down their answer. Then compare it to your current plan. If they can’t give you a clear answer, walk away. You don’t need another insurance surprise.What if my generic drug isn’t on the new plan’s formulary?

If your drug isn’t covered, you have options. First, ask if there’s a similar generic on the formulary - sometimes the active ingredient is the same, just a different brand. If not, you can file an exception request. Most plans allow this if your doctor says the alternative won’t work for you. You’ll need a letter from your provider. Don’t assume you’re stuck - appeals work more often than people think.

Can I switch plans mid-year just because my drug coverage changed?

Generally, no. Open enrollment is the only time you can switch unless you qualify for a special enrollment period. Common triggers include moving to a new state, losing other coverage, or getting married. But if your plan changes its formulary mid-year and drops your drug, you may qualify for a special enrollment to switch to another plan. Contact your state’s insurance department or Medicare for guidance.

Why does my generic cost more than the brand-name version?

It shouldn’t - and usually doesn’t. But sometimes, insurers put generics in higher tiers because of rebates they get from brand-name manufacturers. If a brand-name drug pays a big rebate to the insurer, they might make the generic more expensive to push you toward the brand. That’s why you always need to check the formulary, not just assume generics are cheaper.

Do mail-order pharmacies always save money on generics?

Usually, yes - but not always. Mail-order plans often offer 90-day supplies for the price of two 30-day fills, which saves you 30-40%. But if your mail-order pharmacy isn’t in-network, you could pay more. Always compare the cost at your local pharmacy versus the mail-order option using your plan’s calculator. Some plans even charge extra shipping fees.

How do I know if my plan has an integrated deductible?

Look at your Summary of Benefits and Coverage (SBC). If it says “medical and prescription drug deductible combined” or “one deductible for all services,” then yes. If it lists “prescription drug deductible” separately, then no. Integrated deductibles are dangerous for people on daily meds. You could spend $2,000 on doctor visits before your pills are covered.

Comments (9)

AARON HERNANDEZ ZAVALA

5 Dec 2025

Just switched plans last month and didn't check the formulary. My metformin went from $5 to $32. I skipped doses for two weeks. My A1C is higher now. Don't be like me.

Craig Ballantyne

6 Dec 2025

The structural inefficiencies in formulary tiering are a direct consequence of PBMs leveraging rebates to distort market incentives. The clinical equivalence of generics is functionally irrelevant when financial arbitrage governs formulary placement. This is not a coverage issue-it's a systemic misalignment of pharmaceutical economics.

Robert Asel

6 Dec 2025

You're all missing the point. The real issue is that consumers are being deliberately misled by insurers who bury formulary changes in PDFs that are updated without notice. The Centers for Medicare & Medicaid Services (CMS) has published guidelines requiring advance notice of formulary changes, yet enforcement is nonexistent. This is not negligence-it's predatory compliance. You need to file complaints with your state’s insurance commissioner, not just complain on Reddit.

Shannon Wright

8 Dec 2025

I want to say thank you for writing this-seriously. I’ve been helping my mom navigate Medicare Part D for years, and I’ve seen how confusing this all is. One time, she was paying $40 for her thyroid med until we found out it was listed as non-preferred, even though it was the exact same pill she’d been on for 12 years. We called the insurer, got the formulary document, and filed an exception. It took three weeks, but they approved it. You’re not powerless. You just have to be persistent. Write down every detail. Call multiple times. Ask for supervisors. And if you’re helping someone else, don’t let them give up. Their health depends on it.

vanessa parapar

9 Dec 2025

Wow, you actually did your homework. Most people just pick the cheapest premium and then cry when their insulin costs $150. You’re one of the few who knows that ‘generic’ doesn’t mean ‘cheap’ anymore. Good job. Now go tell your friends.

Ben Wood

10 Dec 2025

...and yet... nobody... talks about... the fact... that... insurers... are... literally... paying... brand-name... manufacturers... to... make... generics... more... expensive...?!... This... isn't... just... bad... policy... it's... a... cartel... and... we're... the... suckers... paying... for... it... with... our... health... and... our... dignity...

Sakthi s

12 Dec 2025

Check formulary. Call insurer. Save money. Simple.

Rachel Nimmons

14 Dec 2025

I think this whole system is rigged. Did you know that some formularies are secretly influenced by pharmaceutical lobbying? The same companies that make the drugs also fund the insurers’ data systems. They’re not just changing tiers-they’re controlling your access. If you’re on a long-term med, you’re being watched. And they’ll raise your price when they know you can’t switch.

Abhi Yadav

14 Dec 2025

It's not about the pill... it's about the system that turns healing into a transaction... we are not patients... we are consumers... and the market has forgotten that life is not a spreadsheet... 🤔